Online Banking Security: 7 Tips for Keeping Your Info Safe

Seventy-eight percent of adults in the United States prefer to bank online than visit a physical branch in person. But due to the open nature of the internet, online banking poses significant security risks, such as malware, phishing, and identity theft.

It's natural to worry about these risks, especially if you rely on online banking in your business. However, two-factor authentication, changing your passwords regularly, and using a password manager, among other simple steps, can keep you safe online. In this guide, get online banking security tips and learn how to securely manage your finances on the internet.

Here are five things you should know about online banking security:

- Thirty-one percent of banking customers have recently experienced data security issues, according to research

- Internet banking security risks include malware, phishing, and hacking

- You can take various steps to protect your online banking security, including checking your accounts frequently

- Changing passwords regularly, using a password manager, and being aware of scams can also reduce internet banking threats

- TeamPassword helps you manage your online banking passwords and increase internet security

Table of Contents

How Secure Is Online Banking?

Online banking is generally safe. That's because financial institutions follow strict security protocols to protect your information, such as 128-bit or 256-bit data encryption. However, that doesn't mean your bank account isn't at risk. Thirty-one percent of banking customers have recently had their accounts hacked, information compromised, or experienced other data security issues.

If you experience one of these issues, your bank should refund any fraudulent deposits from your account. The FDIC also protects the money in your account up to a specific amount in case of a bank failure. However, you should take additional steps to keep your money safe, especially from hackers. These steps include ensuring your online banking passwords are safe.

Online Banking Risks

Here are some of the most common online banking security risks:

- Phishing: When someone pretending to be from your bank asks for account information such as passwords and credit card numbers via email or text.

- Hacking: When hackers break into your bank account and steal your money or change your details. Also known as account takeover (ATO).

- Identity theft: When someone steals your identity, often by hacking into your bank account, and opens up new credit accounts in your name.

- Malware: When malicious software infects your computer, allowing cybercriminals to capture your login information and other online banking credentials.

It's impossible to prevent all online security banking risks. However, many scams happen because of the way people use their accounts. For example, using the same password across different banks can increase the chances of fraud. If you're guilty of doing this, it's time to break this habit.

Online Banking Security: 7 Tips for Securing Your Info

Securing your online banking credentials might sound like a chore. However, it can significantly reduce the chances of a fraud event. Follow these seven tips for better banking security:

1. Choose Strong Passwords

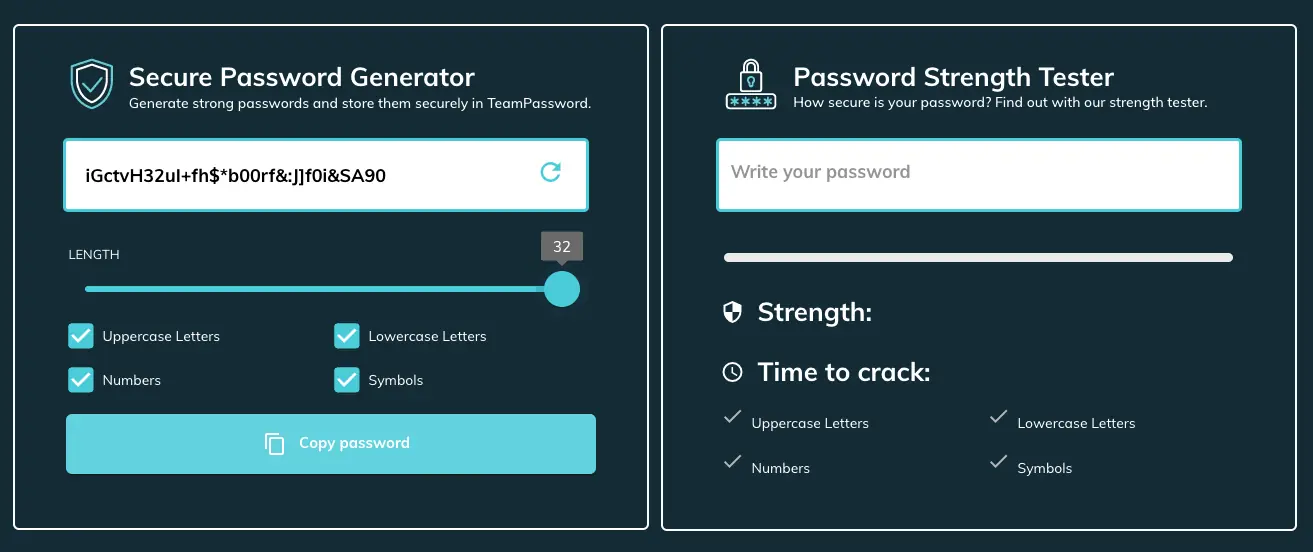

Safeguard your digital assets with strong, unique passwords. Regularly updating your passwords is a critical security measure that can significantly reduce the risk of unauthorized access. A password generator, like the one provided by TeamPassword, can simplify this process by automatically creating complex, random passwords.

The stronger your internet banking password, the better. That's because hackers can easily crack weak passwords and infiltrate your online accounts. A strong password consists of at least 12 (preferably 16+) random letters (upper and lowercase), numbers, and special characters such as the "$" symbol.

Passphrases — strings of words that form a memorable phrase — are effective passwords if done correctly. However, hackers will guess famous quotes, sayings, and lyrics.

Here are some additional tips for creating and managing strong passwords:

- Avoid using easily guessable information like birthdays, pet names, or common phrases.

- Combine uppercase and lowercase letters, numbers, and symbols to create a more complex password.

- Enable two-factor authentication whenever possible for an extra layer of security.

- Store your passwords securely using a password manager or a reliable method.

By following these guidelines and using a password generator, you can significantly enhance your online security and protect your digital identity.

2. Change Passwords Regularly

Changing your passwords, preferably every few months, will limit the amount of time hackers can access your account if they already have your credentials. A password generator, such as the one offered by TeamPassword, can help you with this. It automatically generates random passwords, simplifying the password creation process. Creating strong and unique passwords for every one of your accounts is the best way to prevent an attack.

3. Use Two-Factor Authentication

Two-factor authentication (2FA) provides an additional layer of protection for banking online. It requires you to confirm your identity twice before accessing your account. For example, entering your login information and a time-based security code from an authenticator app like Authy. When possible, DO NOT uses SMS-based (text message) 2FA - it is less secure than an authenticator app due to an attack called SIM-swapping and can be used for other nefarious purposes.

Some banks require you to set up 2FA before using your online account. However, others give you the option to enable 2FA in your account settings. This process involves linking your account to an additional electronic authentication method, such as your phone.

4. Stay Skeptical of Scams

Common online banking scams include phishing attacks, social engineering, and password cracking — when hackers guess your password with nefarious technology. Fraudsters can also steal your information if you log into your bank account over an unstable public Wi-Fi connection. It's critical to be aware of the latest scams and look for any red flags that suggest your security is at risk. For example, if you receive a suspicious-looking email from someone purporting to be from your bank, don't click on any links in the message. Instead, reach out to your financial institution to confirm the email is genuine.

5. Use Your Financial Institution's Security Offerings

Banks often provide security features that can keep you safe online. For instance, text alerts if the institution suspects suspicious activity on your account. You might have to opt into these features in your account settings or talk to someone from your bank about setting them up. Whatever the process is, you must use all of your institution's security offerings to protect yourself on the internet.

6. Use a Password Manager

You likely use multiple passwords for different online accounts, including your bank accounts. Using a password manager is the safest way to store and protect all your credentials for various internet services. It keeps your passwords in one secure place so you don't have to remember them.

When setting up your password manager, you'll be asked to create a "master password". This should be a super-strong, unique password that you memorize. With proper zero-knowledge password managers, they cannot reset your master password if you forget it. If they could, a cybercriminal who hacks the password manager company could also reset your master password and gain entry to your password vault.

For this reason, a long, unique passphrase is usually the best type of master password.

TeamPassword's Password Manager lets you create, manage, and access passwords across the internet on your computer or mobile devices. Features include activity logging, enforceable 2FA, secure encryption technology, and the ability to share credentials with groups. You can create strong and unique passwords for all your accounts, which provides peace of mind on the internet.

7. Check Your Accounts Regularly

Checking your bank accounts online at frequent intervals will help you identify any fraudulent transactions. You can flag these charges with your institution and get your money back. Aim to check your accounts every 1-2 weeks to look for unauthorized activity. If fraud has taken place, you'll need to change your online banking password immediately.

Improve Your Online Banking Security With TeamPassword

There are multiple online banking security risks you need to know about. However, you can reduce these risks by protecting your information online. Following the seven tips above can decrease the chances of a fraud event.

TeamPassword can also help you reduce online banking fraud. For example, our Password Manager lets you create, store, and access strong passwords for your online bank accounts in one place, making it harder for hackers to steal your credentials.

Our browser extensions let you access and autofill credentials without clicking between windows, and our dead-simple UI means you can jump right in without learning another complicated piece of software.

Try TeamPassword for free for 14 days and start protecting your business now!

Online Banking Security FAQs

What Is the Best Way to Protect Online Banking?

The best way to protect your credentials is to follow the seven online banking security tips listed above. These tips are:

- Choose strong passwords

- Change passwords regularly

- Use two-factor authentication

- Stay skeptical of scams

- Use your financial institution's security offerings

- Use a password manager

- Check your accounts regularly

What Is an Example of a Good Password for Online Banking?

A good password consists of at least 12 random letters, numbers, and special characters. For even better security, use a combination of lower and upper case letters. Here are some examples of good passwords:

- Ju!4hPONg&u1

- PP9*g5nW91%H

- J&"Hfwp01H£n

While online banking is generally safe, your business could still be at risk of a fraud event. Take a little time to protect your information online and invest in a password manager to make your life easier. After safeguarding your bank accounts, consider securing your other online accounts, including social media profiles.

Enhance your password security

The best software to generate and have your passwords managed correctly.